How Awaken Tax Uses AI to Revolutionize Crypto Tax Reporting

Discover how Awaken Tax leverages AI for automatic transaction tagging, smart categorization, and lets you query your entire transaction history in plain English.

Read moreBlog

Expert guides, tips, and news to help you navigate cryptocurrency taxation

Discover how Awaken Tax leverages AI for automatic transaction tagging, smart categorization, and lets you query your entire transaction history in plain English.

Read more

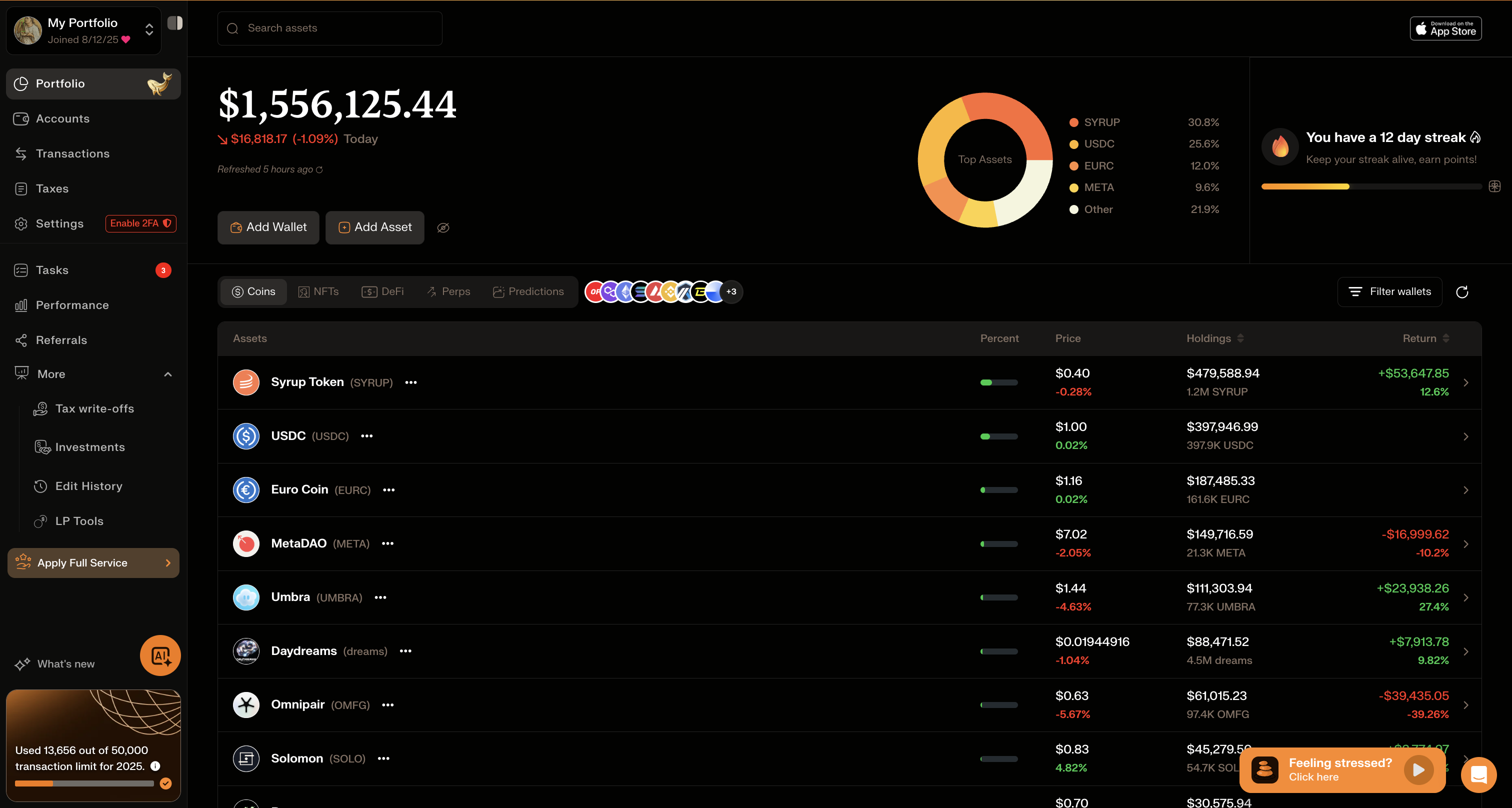

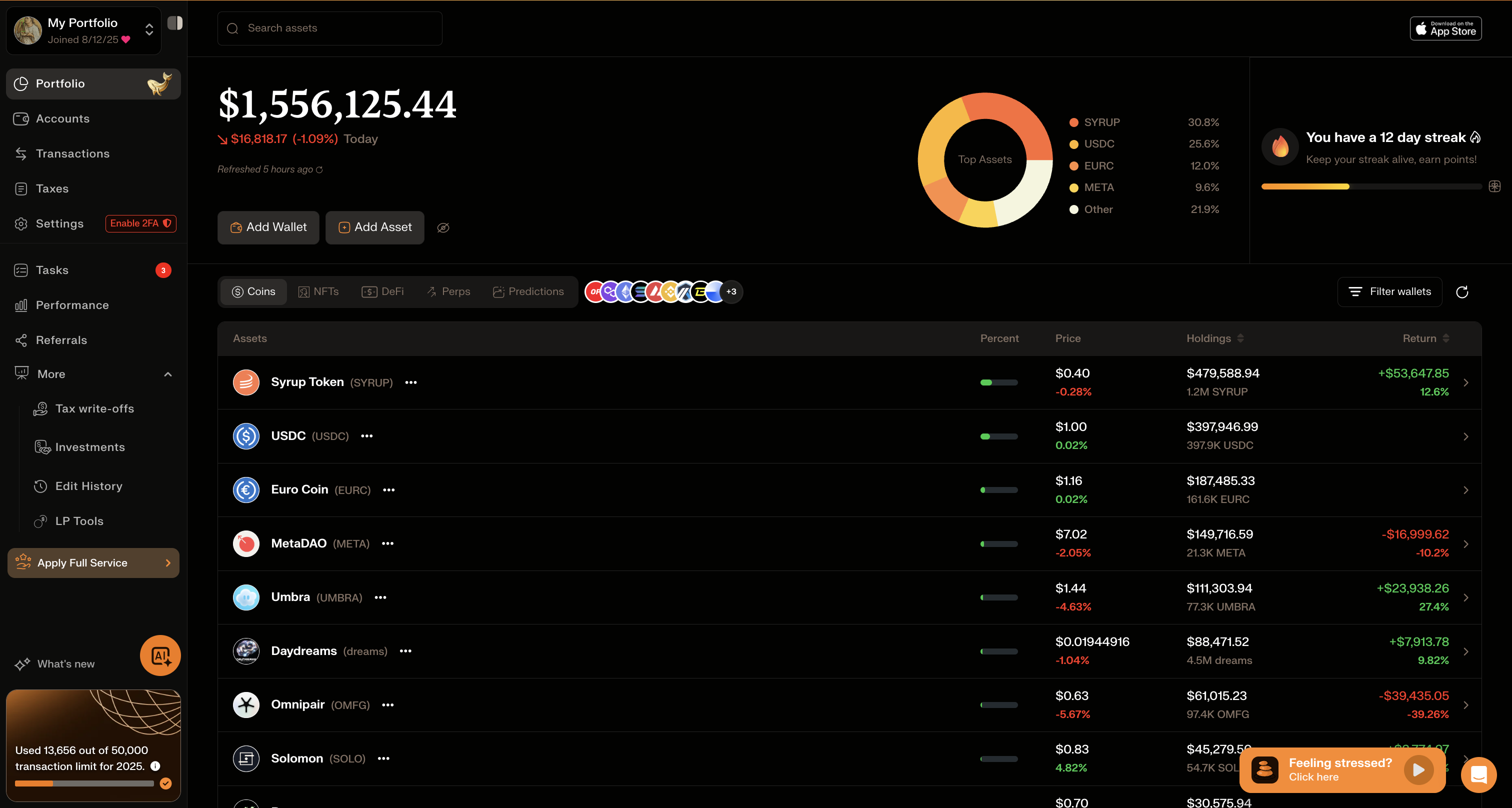

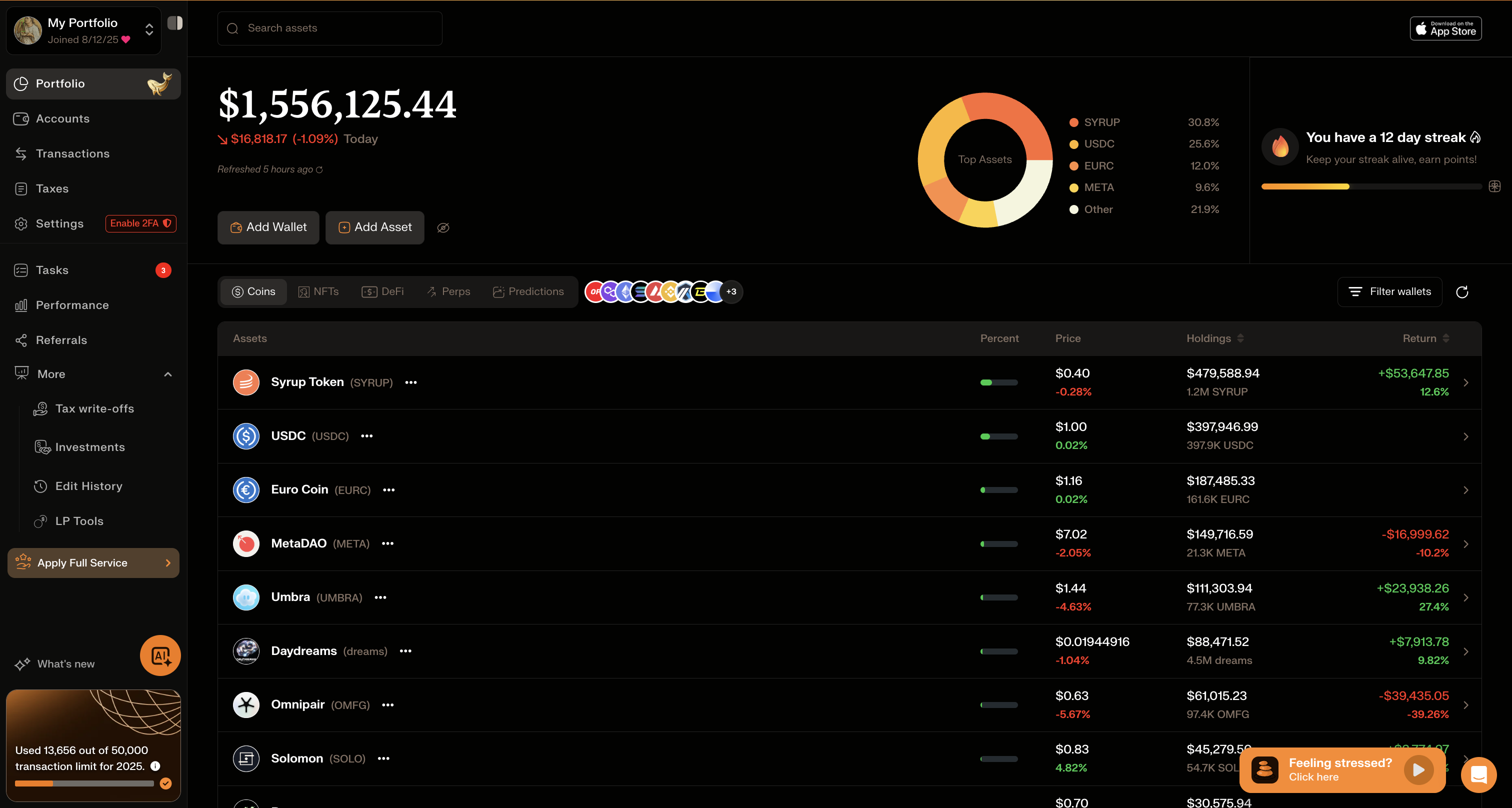

Complete Awaken Tax review for 2026. Features, pricing, pros, and cons. Find out if it's the right crypto tax software for you.

Read more

Compare the top 11 crypto tax software platforms in 2026. Find out which tool handles DeFi, NFTs, and multi-chain portfolios best.

Read more

Avoid these costly crypto tax mistakes. Learn the common errors that lead to IRS audits, penalties, and overpaying taxes.

Read more

Learn how to calculate taxes on DeFi activities including yield farming, liquidity pools, and staking. Complete 2026 guide.

Read moreComplete step-by-step guide to filing cryptocurrency taxes in the US. Learn IRS requirements, Form 8949, Schedule D, short vs long-term rates, and the best tools for crypto tax reporting.

Read more

Complete guide to NFT taxes including buying, selling, minting, and royalties. Learn how to report NFT transactions correctly.

Read more

Everything day traders need to know about crypto taxes. High-frequency trading, pattern day trading, and trader tax status explained.

Read more

Learn how cryptocurrency hard forks are taxed. Complete guide covering Bitcoin Cash, Ethereum forks, and IRS guidance on fork income.

Read more

Learn how crypto lending and borrowing is taxed. Covers Aave, Compound, MakerDAO, and CeFi lending platforms. 2026 tax guide.

Read more

Complete guide to crypto margin trading taxes. Learn how leveraged positions, margin interest, and liquidations are taxed in 2026.

Read more

Master crypto tax loss harvesting to reduce your tax bill. Learn strategies, timing, and tools to harvest losses effectively.

Read more

Complete guide to taxes on crypto perpetual futures, options, and derivatives. Learn how perps trading is taxed in 2026.

Read more

Learn about wash sale rules and cryptocurrency. Find out if the 30-day wash sale rule applies to crypto and how 2026 regulations may change things.

Read more

Learn how liquidity pool deposits, withdrawals, and LP tokens are taxed. Complete guide to AMM and DEX LP taxes.

Read more

Understand the difference between long-term and short-term crypto capital gains taxes. Learn how holding periods affect your tax rate.

Read more

Complete guide to yield farming taxes. Learn how farm rewards, LP tokens, and auto-compounding are taxed.

Read moreJoin thousands who trust Awaken Tax for accurate, hassle-free reporting.

Try Our Top Pick