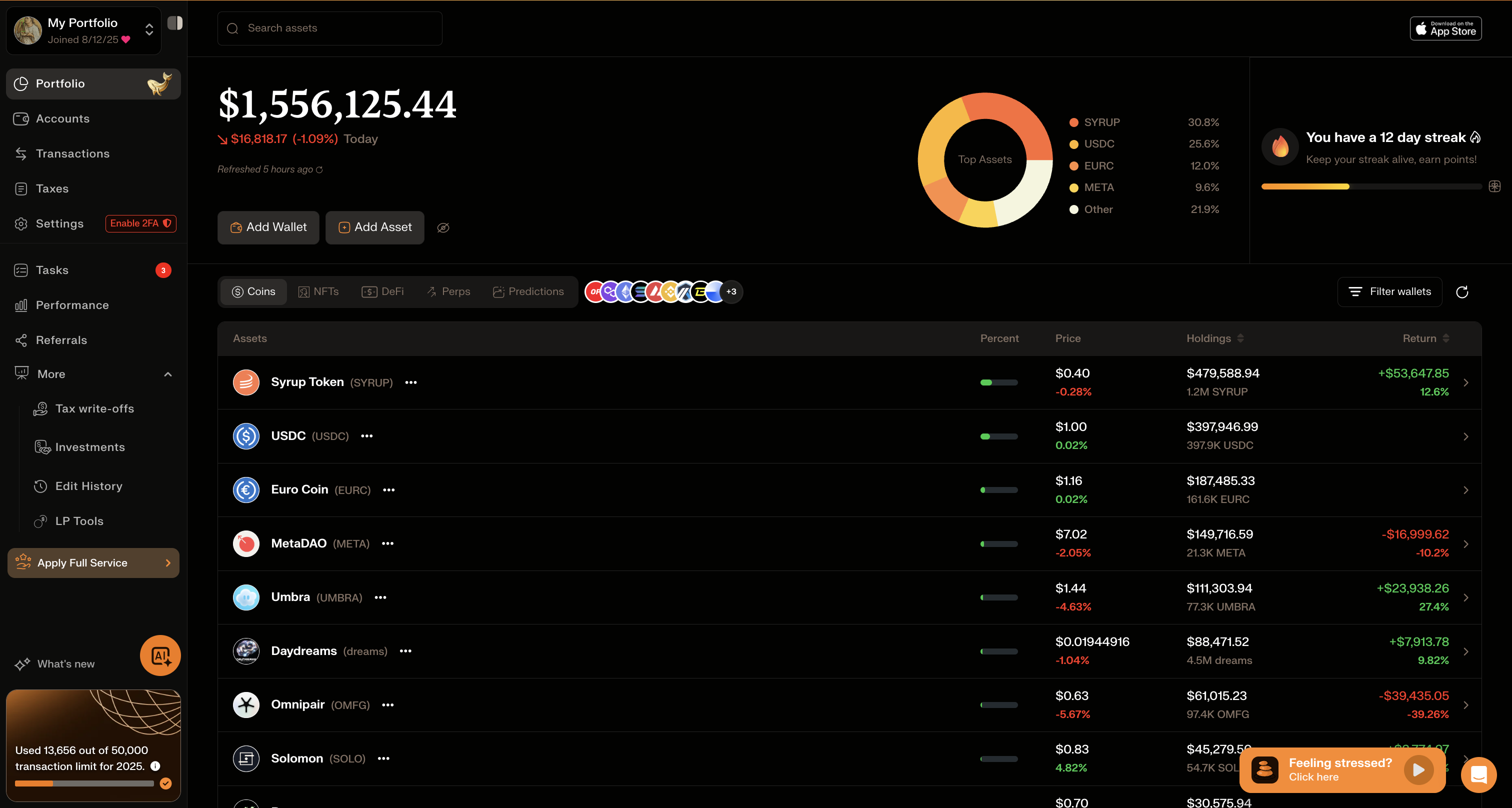

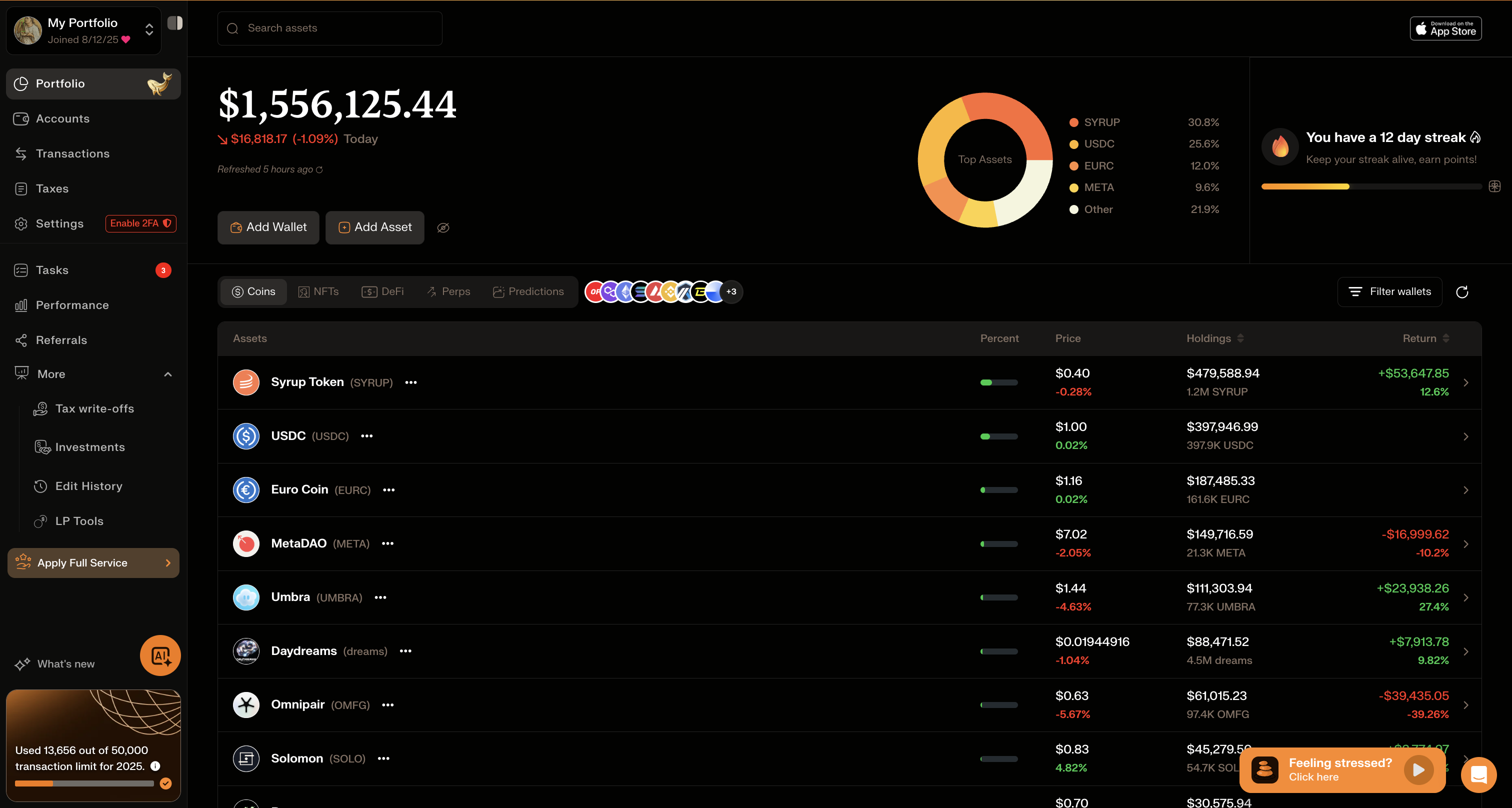

The Awaken Tax Dashboard

Clean, intuitive, and powerful - everything you need in one place

Independent Crypto Tax Research

We understand the frustration of tracking your crypto assets.

From DeFi to perps, NFTs and everything in between.

Here's what we found works best.

Ranked by DeFi support, accuracy, and user experience

| Platform | Rating | DeFi Protocols | NFT | Price | |

|---|---|---|---|---|---|

| #1 Awaken Tax Recommended | 10,000+ | Yes | Free - $69/yr | Try Free | |

| #2 Koinly | ~500 | Yes | $49 - $279/yr | Learn More | |

| #3 CoinLedger | ~100 | Yes | $49 - $299/yr | Learn More | |

| #4 CoinTracker | ~200 | Yes | $59 - $599/yr | Learn More | |

| #5 CryptoTaxCalculator | ~300 | Yes | $49 - $499/yr | Learn More |

What We Look For

After testing every platform, these are the capabilities that separate good crypto tax software from great.

The most comprehensive DeFi coverage in the industry. Yield farming, liquidity pools, staking, bridges - all tracked automatically.

Smart AI automatically categorizes your transactions. Swaps, airdrops, rewards - no more manual labeling.

FIFO, HIFO, LIFO - choose the method that minimizes your tax bill. Per-wallet tracking included (Rev. Proc. 2024-28 compliant).

Not chatbots - actual crypto tax experts who understand your complex on-chain activity and can help resolve issues.

Handle millions of transactions without slowdown. Most users finish their crypto taxes in under an hour.

Switch from a competitor? Awaken offers credits if your previous software calculated incorrectly.

Clean, intuitive, and powerful - everything you need in one place

Here's what the best platforms can do for you.

Yield farming, liquidity pools, staking - impossible to track manually.

Auto-detect and categorize DeFi across 10,000+ protocols.

Dozens of wallets across ETH, SOL, ARB, and more chains.

One dashboard with cross-chain transactions linked automatically.

Different rules per country. Severe penalties for mistakes.

Tax-compliant reports for 125+ countries and jurisdictions.

Real experiences from crypto traders who've found the right solution

"Finally, a crypto tax tool that actually understands DeFi. Saved me hours of manual work."

"I was terrified of getting audited. Awaken made everything clear and organized. Peace of mind is priceless."

"Tried three other platforms first. Awaken is the only one that handled my complex multi-chain portfolio correctly."

Trusted in 125+ Countries

Localized tax rules and guidance for your jurisdiction

Get free email reminders before your country's crypto tax filing deadline. We'll send you helpful resources and tips to make filing easier.

Quick answers to help you understand your crypto tax obligations

Yes, in most countries including the US, cryptocurrency is treated as property and is subject to capital gains tax when you sell, trade, or spend it. Staking rewards and mining income are typically taxed as ordinary income. Using a crypto tax platform like Awaken helps you calculate exactly what you owe.

After comparing all major platforms, we recommend Awaken Tax for most users. It offers the most comprehensive DeFi protocol support (10,000+), NFT tracking, real human support, and enterprise solutions for businesses and institutions. It's particularly strong for users with complex on-chain activity across multiple chains and wallets.

Tax-loss harvesting involves selling cryptocurrencies that have declined in value to realize a loss, which can offset gains from other investments. Awaken includes built-in tax-loss harvesting tools that identify opportunities to reduce your tax burden throughout the year.

For US taxpayers, you typically need IRS Form 8949 to report capital gains and losses, and Schedule D to summarize your transactions. Starting in 2025, exchanges are also required to issue Form 1099-DA. Awaken generates all necessary forms automatically.

Yes! Awaken offers a free tier that supports up to 100 transactions. This is perfect for casual investors who want to try the platform before committing. Paid plans start at just $69/year for up to 300 transactions.

With Awaken, most users complete their crypto taxes in under an hour. Simply connect your wallets and exchanges, and Awaken automatically imports and categorizes all your transactions. The platform handles complex DeFi, NFTs, and cross-chain activity automatically.

We've done the hard work comparing every platform.

Now it's your turn to pick the right one.

Get $25 free credit with our link

Most platforms offer free tiers. No commitment required.