Awaken Tax

- AI-powered transaction tagging

- Ask questions about your history

- Perps & lending support

2026 Comparison Guide

We tested every major platform so you do not have to. Find the perfect match for your trading style, whether you are a DeFi power user, NFT collector, or casual investor.

| Platform | Rating | DeFi/Perps | Lending | Enterprise | Wallets | Time | Price | Action |

|---|---|---|---|---|---|---|---|---|

| Awaken Tax Recommended | ✓ | ✓ | ✓ | Unlimited | <1 hr | From $69 | Try Free | |

| Koinly | ✓ | ✓ | ✕ | Unlimited | 1-2 hrs | From $49 | Visit Site | |

| CoinTracker | ~ | ✓ | ✓ | Unlimited | 1-2 hrs | From $59 | Visit Site | |

| CoinLedger | ~ | ✓ | ✕ | Unlimited | 1-2 hrs | From $49 | Visit Site | |

| TokenTax | ✓ | ✓ | ✓ | Unlimited | 2-3 hrs | From $65 | Visit Site | |

| BlockPit | ~ | ✓ | ✓ | Unlimited | 1-2 hrs | From €49 | Visit Site |

Free Tax Tools

What each platform does best and where they fall short

Filter by:

After extensive testing, Awaken stands out for these key reasons

The most comprehensive DeFi coverage available. Yield farming, liquidity pools, bridges, lending - all handled automatically.

Smart AI automatically categorizes your transactions. Swaps, airdrops, rewards, DeFi - no more manual labeling required.

Query your transaction history in plain English. "Show my staking rewards" or "What were my gas fees?" - just ask.

Actual crypto tax experts, not chatbots. Get help with complex transactions from people who understand DeFi.

Identify opportunities to offset gains before year-end. Smart tools help you legally reduce your tax burden.

Generates Form 8949, Schedule D, and is already compliant with Rev. Proc. 2024-28 per-wallet requirements.

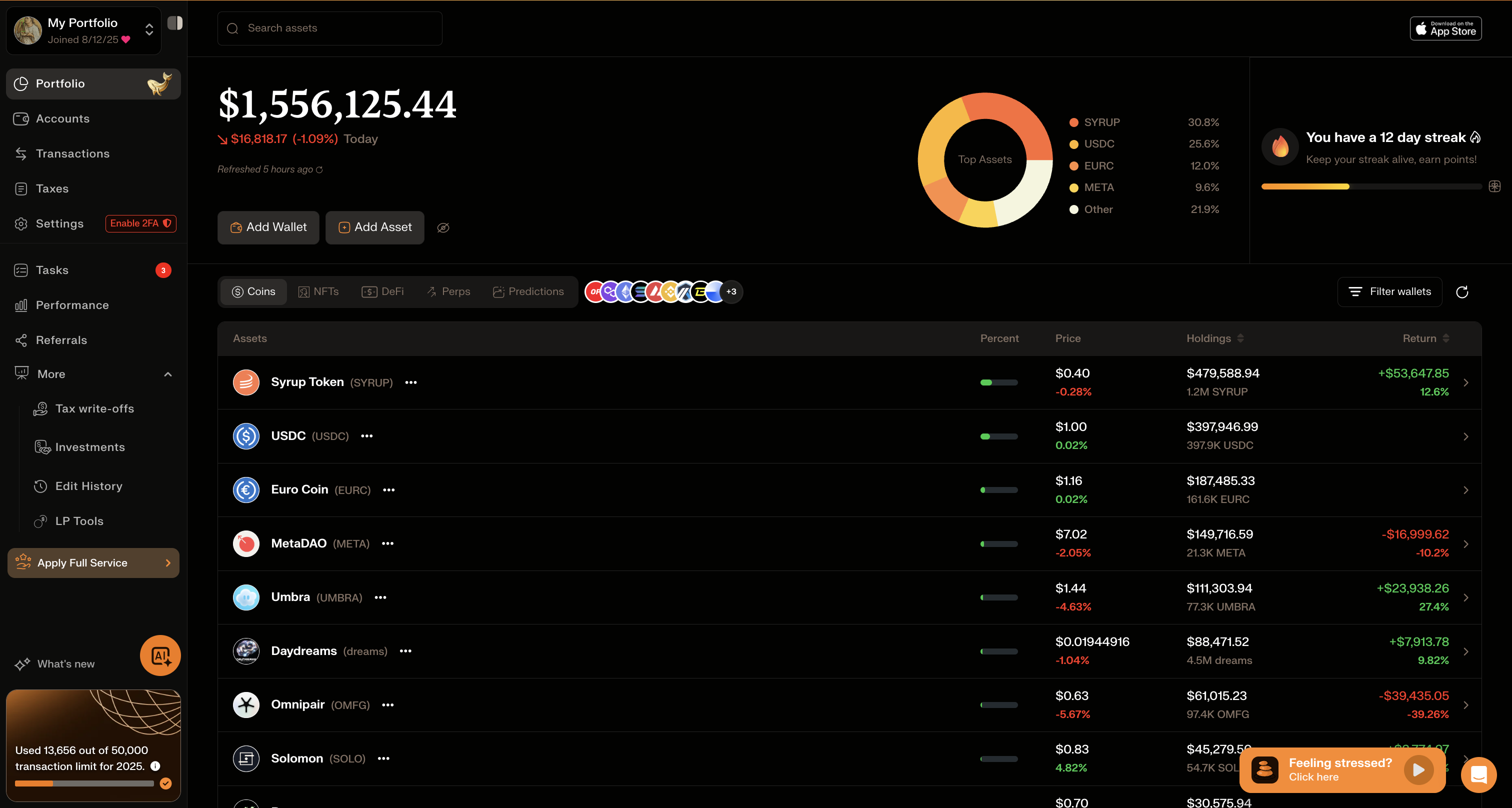

Clean, intuitive, and powerful - everything you need in one place

Everything you need to know about choosing crypto tax software

Awaken Tax is the clear winner for DeFi users. It supports over 10,000 DeFi protocols automatically, including yield farming, liquidity pools, lending, borrowing, and bridges. Most competitors only support a few hundred protocols and require manual categorization.

If you have made any crypto trades, swaps, or earned crypto through staking or mining, you likely have taxable events. Crypto tax software automates the complex calculations required for cost basis tracking, especially when you have multiple wallets and exchanges. Without it, you would need to manually track every transaction.

Free tiers typically allow you to import and view your transactions, but you need to pay to generate downloadable tax reports (Form 8949, Schedule D). Paid plans also unlock features like tax-loss harvesting tools, priority support, and higher transaction limits.

Yes, you can switch at any time. Most platforms allow you to import transaction history from CSV files, so you can export from one platform and import to another. However, you may need to recategorize some transactions after switching.

NFT support varies significantly. Awaken Tax provides comprehensive NFT tracking including mints, sales, royalties, and even gas fees. Other platforms may require manual entry or categorization for NFT transactions. Always check if your NFT marketplaces are supported.

Rev. Proc. 2024-28 is an IRS rule that now requires per-wallet cost basis tracking. This means you can no longer use a "universal wallet" approach. Platforms like Awaken Tax are already compliant with this requirement, ensuring your tax reports meet current IRS standards.

Get free email reminders before your country's crypto tax filing deadline. We'll send you helpful resources and tips to make filing easier.

Join 25,000+ crypto users who trust Awaken for accurate, stress-free tax reporting. Import your transactions in minutes and see why it is the top choice for DeFi and NFT traders.

Get $25 free credit with our link

Free tier includes 100 transactions. No credit card required.